|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

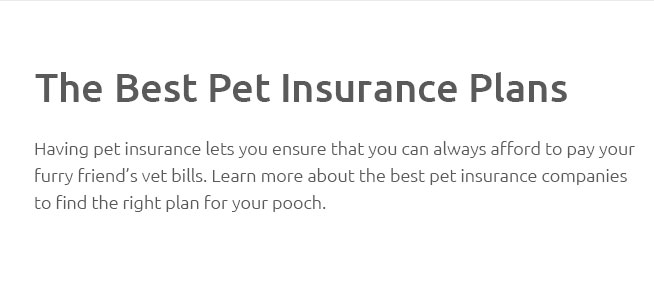

Immediate Pet Insurance: Navigating the Landscape of CoverageIn the realm of pet ownership, the concept of immediate pet insurance emerges as a crucial consideration, offering a safety net that provides peace of mind for many pet owners. Yet, as with any financial product, there are nuances and potential pitfalls that one must navigate carefully. This article aims to shed light on common mistakes to avoid when venturing into the world of pet insurance. Firstly, it's essential to understand what immediate pet insurance entails. Unlike standard policies that may have waiting periods before certain types of coverage become active, immediate pet insurance is designed to provide almost instant coverage for accidents or illnesses, which can be an attractive feature for those who seek prompt financial protection. However, one of the most common mistakes pet owners make is not reading the fine print thoroughly. Many assume that 'immediate' implies comprehensive, but in reality, these policies often have limitations. For instance, pre-existing conditions are typically not covered, and there may be caps on the reimbursement amounts. Another frequent error is failing to compare different insurance providers. With the pet insurance market becoming increasingly competitive, a multitude of options are available, each with their unique offerings and drawbacks. Pet owners should invest time in comparing plans, assessing not only the premiums but also the extent of coverage, the reputation of the insurer, and the ease of claim processing. It's also wise to consider the specific needs of your pet. Factors such as breed, age, and lifestyle can greatly influence the type of coverage that would be most beneficial. For instance, certain breeds may be prone to hereditary conditions that are not covered under all plans. Thus, having a detailed understanding of your pet's potential health risks can guide you in selecting the most appropriate policy. A subtle yet impactful mistake is overlooking the policy's renewal terms. Some insurers may change the terms of coverage upon renewal, often increasing premiums or altering coverage limits. Being aware of these potential changes in advance can prevent unpleasant surprises and financial strain in the future.

Ultimately, while immediate pet insurance can be a valuable tool for mitigating unexpected veterinary expenses, it requires careful consideration and due diligence. By avoiding these common mistakes, pet owners can ensure they select a policy that truly meets their needs, providing a safety net that allows them to focus on what matters most: the health and happiness of their beloved companions. https://www.petinsurance.com/whats-covered/emergency-pet-insurance/

Life-threatening dog or cat emergencies can strike at any time. Our emergency vet insurance provides comprehensive support to ... https://spotpet.com/emergency

Spot's accident and illness plan can help provide your pet with emergency coverage in pet insurance, helping provide crucial coverage when unexpected accidents ... https://petcube.com/blog/pet-insurance-with-no-waiting-period/

The concept of 'no waiting period' pet insurance is highly appealing to pet owners seeking immediate protection for their four-legged friends.

|